BTC Price Prediction: Will It Reach $90,000 Amid Technical Pressure and Mixed Sentiment?

#BTC

- Technical Resistance at Moving Average: Bitcoin must break above the 20-day MA at $91,095 to regain bullish momentum toward $90,000.

- Mixed Fundamental Signals: Strong institutional adoption (ETF growth) contrasts with liquidation risks and macroeconomic uncertainty.

- Seasonal December Pattern: Historical bullish tendencies in December could provide the catalyst needed to overcome technical resistance.

BTC Price Prediction

Technical Analysis: BTC Trading Below Key Moving Average

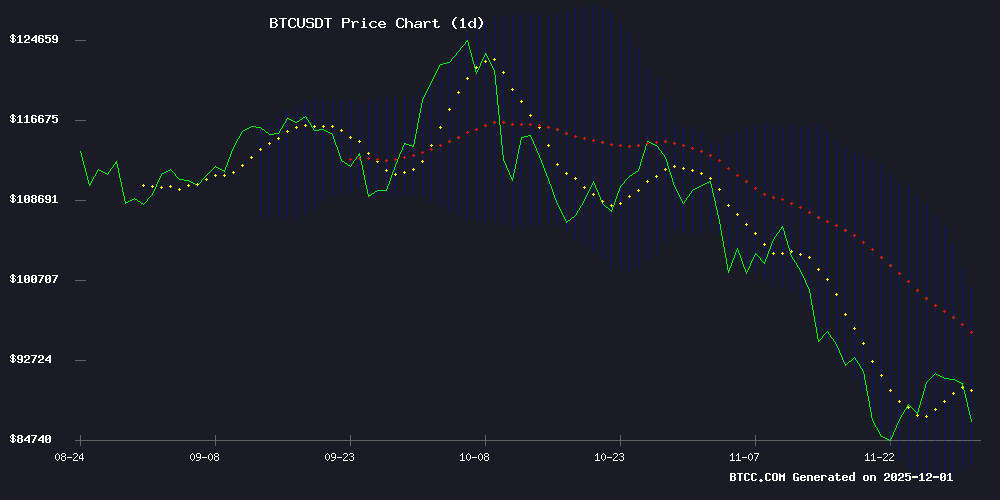

According to BTCC financial analyst Sophia, Bitcoin's current price of $86,484 is trading below its 20-day moving average of $91,095, indicating potential short-term bearish pressure. The MACD reading of -1,602 shows a bearish crossover, with the signal line above the MACD line. However, Bitcoin remains within the Bollinger Bands, with the middle band at $91,095 acting as immediate resistance and the lower band at $82,252 providing support. The price is currently closer to the lower band, suggesting it may be oversold in the near term.

Market Sentiment: Volatility Amid Institutional Adoption

BTCC financial analyst Sophia notes that market sentiment appears mixed. Positive catalysts include BlackRock's bitcoin ETF emerging as a top revenue generator and SEC leaders championing crypto self-custody, which supports long-term institutional adoption. However, headlines about $8 billion in short liquidations looming and on-chain metrics flagging a potential drop to $45,880 create near-term uncertainty. The market is testing key resistance at $98K while traders watch for December's historical seasonal strength, creating a battleground between bullish seasonal patterns and concerning macroeconomic signals.

Factors Influencing BTC's Price

Bitcoin Rebounds as $8B in Short Liquidations Loom Over $100K

Bitcoin has staged a notable recovery, climbing back above $91,000 amid signs of shifting market sentiment. The cryptocurrency now trades at $91,362.03, marking a 1.12% gain over the past 24 hours as buyers cautiously re-enter the market.

Nearly $8 billion in short positions face liquidation risks if Bitcoin surpasses the $100,000 threshold. CoinGlass data reveals mounting liquidity pressure that could fuel a violent upside breakout, with clustered liquidations acting as potential rocket fuel for the next leg up.

Technical indicators suggest strengthening momentum. The Relative Strength Index has emerged from oversold territory while trading volumes show steady accumulation. Bitcoin's ability to maintain support above $91,000 establishes a foundation for potential moves toward the $94,000-$96,000 resistance zone.

BlackRock’s Bitcoin ETF Emerges as Top Revenue Generator

BlackRock's iShares Bitcoin Trust (IBIT) has surpassed all other ETFs in the firm's expansive portfolio to become its most profitable product. Launched in January 2024, IBIT amassed $70 billion in assets within 341 days—setting a record as the fastest-growing ETF in history. The fund now commands $70.7 billion in net assets and is projected to generate $245 million in annual fees by October 2025.

The ETF's 0.25% management fee structure outperforms BlackRock's traditional index funds, including its S&P 500 tracker, despite holding fewer assets. With over $52 billion in net inflows during its debut year, IBIT now controls more than 3% of Bitcoin's total circulating supply—a staggering institutional foothold in the cryptocurrency market.

Cristiano Castro, BlackRock's Brazil business development director, revealed the milestone at São Paulo's Blockchain Conference, calling the adoption curve "a big surprise." The achievement underscores Wall Street's accelerating embrace of crypto assets, even among firms managing $13.4 trillion in traditional assets.

Bitcoin Holds Above $91K as Traders Eye December's Historical Rally

Bitcoin maintains its position above $91,379, with market participants watching for a potential repeat of December's traditional 20% holiday rally. Weekend volatility has been pronounced, with thin liquidity amplifying price swings—a pattern observed repeatedly in 2024.

Analyst Ted (@TedPillows) notes BTC is testing a critical resistance zone, echoing past Sunday pump scenarios. Order-book data from Binance reveals rapid liquidity vacuums during weekends, often reversing when institutional desks return. A 2019 USENIX study of 400+ coordinated pumps found such surges typically fade by Monday.

Sentiment remains cautious (Fear & Greed Index at 28) following Q3's 30% correction. The market now weighs whether current strength reflects accumulation or another transient liquidity event.

Bitcoin Tests Key $98K Level as On-Chain Metrics Flag $45,880 Risk

Bitcoin's price action near $90,700 reveals market tension—bulls defend critical levels while blockchain analytics suggest potential downside to $45,880. The CVDD metric, which tracks coin movement patterns relative to their blockchain age, flashes warning signs reminiscent of previous cycle bottoms.

Analysts note the CVDD indicator accurately predicted the 2018 ($3,200) and 2022 ($16,000) troughs. 'These signals aren't guarantees, but probabilistic roadmaps,' observes Ali Martinez, a prominent on-chain researcher. The current reading implies 47% downside risk from current levels.

Fibonacci retracements and Elliott Wave structures compound the technical uncertainty. Trading desks report increased hedging activity at the $95,000-$98,000 resistance zone, with some institutions accumulating put options targeting $50,000 strikes.

SEC Leaders Champion Crypto Self-Custody as ETF Adoption Reshapes Bitcoin Ownership

SEC Commissioner Hester Peirce has reignited the debate over financial sovereignty by declaring self-custody a fundamental right. Her stance challenges growing reliance on intermediaries as Bitcoin ETFs gain traction.

The crypto market faces a paradox: institutional adoption through ETFs simplifies exposure but distances holders from Bitcoin's foundational ethos. Tax advantages and convenience drive ETF inflows, yet critics warn this undermines decentralization principles.

Regulatory uncertainty looms as Congress delays key crypto legislation to 2026. Meanwhile, high-profile moves like PlanB's embrace of ETFs highlight the tension between pragmatism and ideology in digital asset ownership.

Strategy Sets BTC Liquidity Threshold Amid Market Volatility

Strategy has introduced a BTC Credit Dashboard to reassure investors following recent market turbulence. The firm outlined strict conditions for potential Bitcoin sales: a drop below 1x NAV coupled with capital market constraints would trigger limited disposals.

The dashboard reflects Strategy's delicate balancing act. While maintaining a long-term HODL stance, the firm acknowledges mathematical realities—dividend obligations and funding needs could force strategic sales if premiums evaporate and financing avenues close.

CEO Phong Le emphasized this isn't a policy shift but a circuit breaker. "We're reinforcing our Bitcoin-per-share growth model," he noted, "but won't hesitate to protect shareholder value if market conditions deteriorate." The mechanism relies on continuous capital raises during premium periods to accumulate BTC reserves.

Strategy CEO Affirms Bitcoin Holdings Will Only Be Sold as Last Resort

Strategy, one of the largest institutional holders of Bitcoin with over 640,000 BTC, has reiterated its commitment to retaining its holdings. CEO Phong Le clarified that a sale would only be considered under dire circumstances—specifically, if the company's mNAV ratio falls below 1 and access to capital becomes severely constrained. This stance is framed as a protective measure for shareholder value rather than an active divestment strategy.

The broader market implications loom large. Institutions and corporations now hold 25% of Bitcoin's supply, while whales control another 40%. A coordinated sell-off by major players could destabilize the market, potentially undermining Bitcoin's original vision as a decentralized asset. Strategy's position highlights the delicate balance between institutional adoption and systemic risk.

Bitcoin's November 2025 Plunge: A Test of Conviction Amid Macro Storm

Bitcoin faced its sharpest correction since the 2022 bear market, tumbling from $126,000 to $80,000 as geopolitical tensions and monetary policy collided. The trigger came when former President Trump announced 100% tariffs on Chinese imports, sparking a cascade of liquidations across leveraged crypto positions. Over $19 billion evaporated in 24 hours, while synthetic stablecoins lost their pegs, cratering to $0.65.

Yet beneath the panic, sovereign buyers like El Salvador and Abu Dhabi accumulated, anchoring BTC above $85,000. The Fed’s unwavering rate policy drained liquidity from risk assets, but Bitcoin’s resilience hinted at structural demand. As one trader noted: 'The mempool doesn’t lie—whales were buying the dip.'

Bitcoin’s Bull Market Shifts Gears as Demand Engines Cool

Bitcoin’s relentless rally shows signs of fatigue as key demand drivers lose momentum. The ETF frenzy that propelled prices earlier this year has stalled, with recent data showing net outflows for the first time since January. Meanwhile, stablecoin growth—often a precursor to crypto buying—has plateaued.

Futures markets tell a similar story. Leverage has retreated from extreme levels as traders grow cautious. NYDIG’s analysis suggests this isn’t a market breakdown but rather a natural consolidation after months of unsustainable inflows.

The question now isn’t whether the bull market survives, but how it adapts. Institutional interest remains structurally higher than previous cycles, even if the firehose of ETF money isn’t spraying at full force. Markets digest; they don’t disappear.

Will BTC Price Hit 90000?

Based on current technical indicators and market sentiment analyzed by BTCC financial analyst Sophia, reaching $90,000 in the near term faces significant hurdles but remains possible with specific catalysts.

Technical Perspective: Bitcoin currently trades at $86,484, which is approximately 4% below the $90,000 target. More importantly, it sits below the 20-day moving average of $91,095, which now acts as resistance. The bearish MACD crossover suggests downward momentum may continue in the short term.

Key Levels to Watch:

| Level | Price (USDT) | Significance |

|---|---|---|

| Immediate Resistance | 91,095 | 20-day Moving Average |

| Upper Bollinger Band | 99,937 | Strong Resistance |

| Current Price | 86,484 | - |

| Target | 90,000 | Question Threshold |

| Lower Bollinger Band | 82,252 | Key Support |

Market Sentiment Factors: Positive institutional developments (BlackRock ETF success, SEC custody support) provide fundamental backing, while liquidation risks and macroeconomic concerns create headwinds. December's historical bullish tendency could provide seasonal tailwinds.

Conclusion: A move to $90,000 would require Bitcoin to break above its 20-day MA resistance and overcome the current bearish momentum indicated by the MACD. This is possible if positive news flow accelerates or if December's historical rally pattern materializes, but current technicals suggest consolidation or further testing of support may occur first.